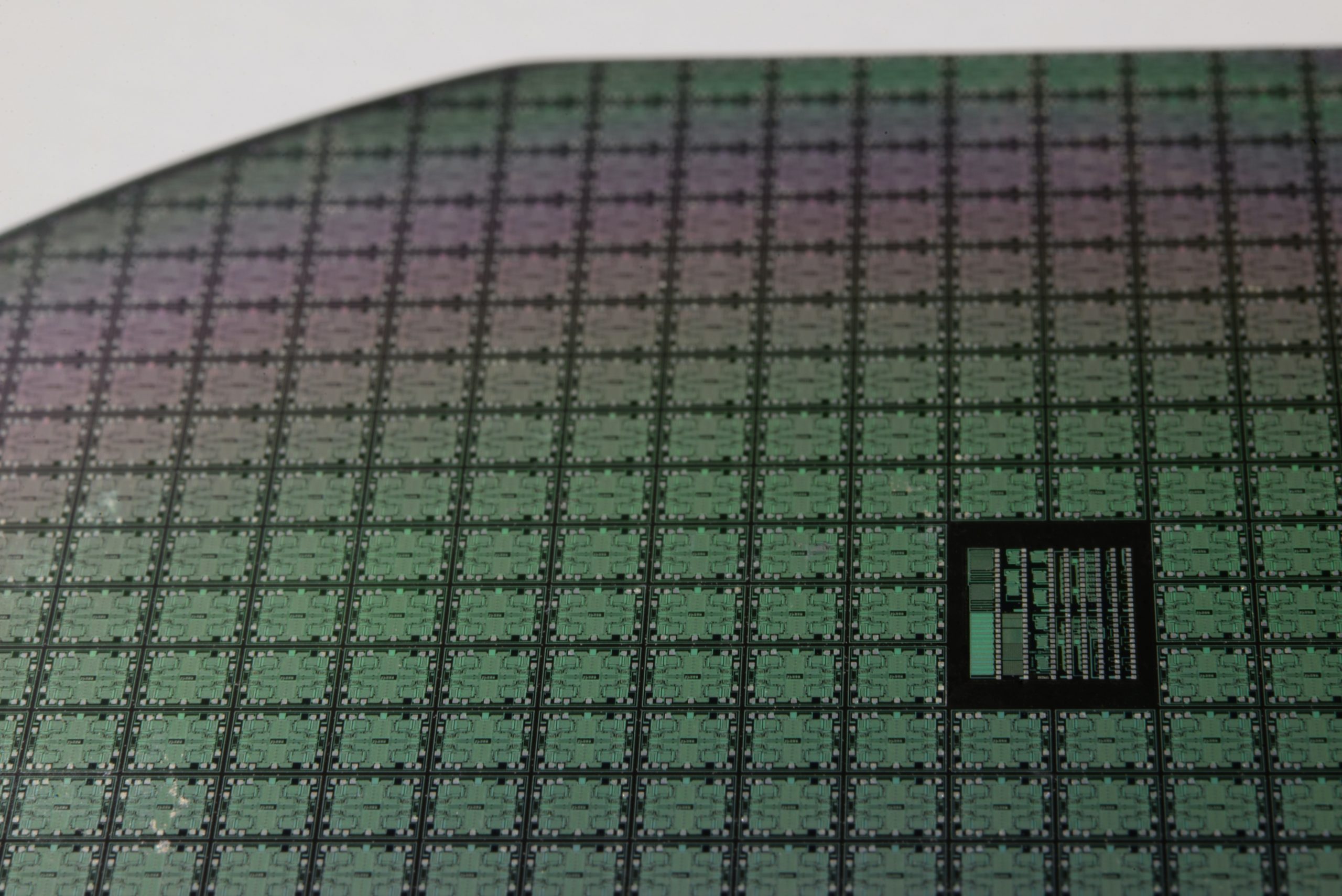

Semiconductors are the brains of modern electronics, enabling highly advanced technologies in healthcare, communications, and computing, among many other applications. Global semiconductor industry sales reached $43.6 billion in May 2021, up by 26.2% over the May 2020 total of $34.6 billion, and 4.1% increase from the previous month’s $41.9 billion, according to the Semiconductor Industry Association (SIA).

Driven by many factors such as government support, huge market volume and increased R&D investment, China, Japan, South Korea and Chinese mainland Taiwan, occupy four of the top six regions in terms of total global semiconductor revenue. These four markets are home to a number of multinational semiconductor companies. Asia Pacific is also the world’s largest semiconductor market, accounting for 60% of global sales, with mainland China alone accounting for more than 30% of the market [1].

Before the start of COVID-19, the global semiconductor industry has seen a downward trend in revenue (IDC data shows a 12% decline in 2019 revenue to $418 billion), mainly due to falling demand and the Sino-US trade dispute. In addition, smartphone inventory pressure and cloud infrastructure construction also led to a decline in prices, which seriously affected semiconductor revenue. The outbreak of the covid-19 outbreak has led to a further contraction in the semiconductor market.

No matter how affected by external factors, the Chinese market will maintain a huge volume. As a terminal market, its importance can not be ignored. In addition to 5G infrastructure development, China will also produce about 70% of the world’s 5G smartphones [2]. In contrast to the past, when Chinese smartphone companies lagged behind international giants, many of the world’s leading smartphone suppliers are now Chinese companies, and these companies will drive the consumption of semiconductor products.

The shortage of semiconductors has become a problem to be solved in many industries such as electronics and automobile. Although many chip makers’ revenue and net profit have become an upward trend, many manufacturers in the supply chain are suffering from order backlogs, rising material and labor costs, power restrictions and other factors. For TSMC, Samsung and other chip manufacturers, although they have announced plans to expand production, but it is difficult to improve the current shortage of core dilemma in the short term. According to the IPC survey, the industry generally believes that the semiconductor shortage may continue beyond 2022, which will also have an impact on the development of the semiconductor and even the global electronics industry.

For companies, the following aspects may need to be improved to reduce losses.

- Improve supply chain transparency by identifying suppliers, locations, parts and products at risk of disruption.

- Companies should explore ways to digitalise their supply chains instead of bouncing between buyers and manufacturers to view samples in person.

- Develop a global perspective to achieve diversified development, companies need to re-engineer the global value chain to reduce risk.

- R&D is critical, and companies with higher revenues can invest more in technology and innovation, and companies need to keep investing to maintain their high competitiveness.

- Upgrading the skills of existing employees, raising wages, providing additional training, and increasing the flexibility of working hours, etc.

The market is projected to grow from USD 452.25 billion in 2021 to USD 803.15 billion in 2028 at a CAGR of 8.6% in the 2021-2028 period. The sudden fall in CAGR is attributable to this market’s demand and growth returning to pre-pandemic levels once the pandemic is over [3]. In recent years, emerging application areas such as cloud computing, Internet of Things, 5G, artificial intelligence, and Telematics have entered a rapid development phase. The fast expansion of emerging application areas also continues to increase the demand for high-end integrated circuits, power devices, RF devices and other products, while also driving the innovation of chip technologies such as sensors, connectivity chips and dedicated SoCs.

[1] https://www.sohu.com/a/417683700_473133

[3] https://www.fortunebusinessinsights.com/semiconductor-market-102365